What Closing Costs Do Sellers Cover in San Diego and Can I Negotiate Them?

TLDR Summary:

Sellers typically cover commission fees, title insurance, and prorated property taxes in San Diego.

Costs may be negotiable, especially in a buyer's market or special circumstances.

Essential inspections include home, pest, and roof inspections—skipping them can risk unexpected repairs.

Specific neighborhoods like La Jolla have unique market factors.

Consult a local expert like Scott Cheng, one of the best San Diego realtors, for tailored advice.

When navigating the San Diego real estate market, understanding the closing costs for sellers becomes crucial. Tracking these costs not only helps in budgeting but also offers leverage in negotiations. As an experienced San Diego realtor, I've seen how this knowledge can become a strategic advantage. Let’s dive into the precise closing costs that sellers often cover in San Diego and explore whether these costs can be negotiated.

What Are the Typical Closing Costs for Sellers in San Diego?

In the bustling real estate market of San Diego, sellers are accustomed to covering several closing costs, which might vary depending on market conditions or the specifics of the property sale. Here’s a detailed look at typical expenses:

1.Real Estate Commission Fees:The commission fee, often split between the seller's and buyer's agents, typically ranges from 5% to 6% of the home's sale price. This is the largest closing cost for sellers. Enlisting the best San Diego broker can ensure that this fee reflects the value of the service provided.

2.Title Insurance:Sellers typically pay for the Owner's Title Insurance, which safeguards against title discrepancies or liens, costing around 0.5% to 1% of the sale price. This insurance puts buyers at ease, ensuring a clear title transfer, especially important in areas like Pacific Beach or Hillcrest.

3.Prorated Property Taxes:Sellers are also responsible for property taxes up to the closing date. The prorated amount will depend on the timing within the tax year, but this is a standard charge across all transactions.

4.Escrow Fees:These fees are split between buyer and seller, averaging from $2 to $3 per $1,000 of the property's value, plus a base fee. For mid-range San Diego homes priced around $700,000 in 2025, expect to pay about $2,100 for these fees.

5.Home Warranty Costs:Providing a home warranty can attract buyers by covering unforeseen repairs. It's negotiable, but offering this can facilitate a smoother transaction.

6.Recording Fees and Transfer Taxes:Required government fees for entering the transaction into public records typically range from $1,000 to $2,000.

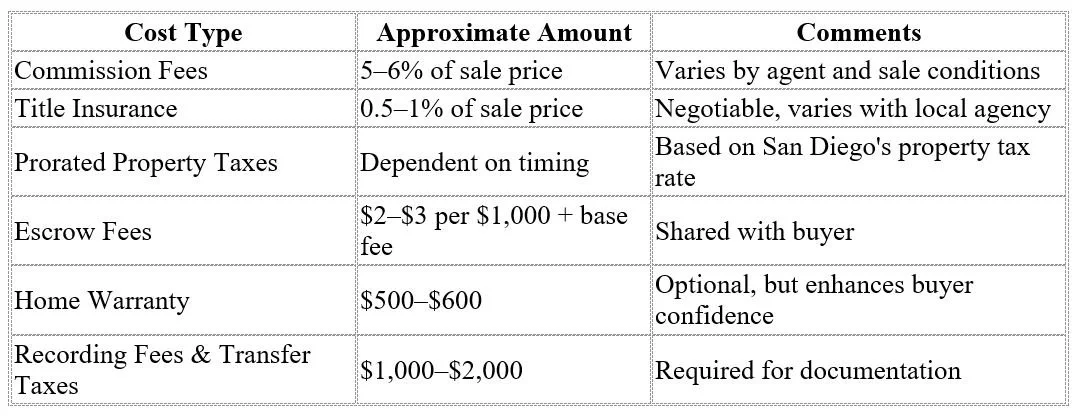

Here's a simplified breakdown of costs in a table:

Can San Diego Sellers Negotiate Closing Costs?

One of my clients in the North Park area faced the challenge of negotiating closing costs during a particularly competitive market. While sellers typically shoulder specific costs, savvy negotiation—supported by a compelling property and skilled negotiation—can shift some costs to buyers.

Market Conditions

San Diego’s real estate scene fluctuates between buyer's and seller's markets. In a buyer's market, where property inventory is high and homes linger longer on the market, sellers might agree to concessions such as covering part of the buyer's closing costs to sweeten the deal. Conversely, in a strong seller's market, where properties in Mission Valley, for example, are snapped up quickly, there’s less incentive for sellers to absorb additional costs.

Property Condition

Another case involved a client’s upscale home in La Jolla. Because the property was impeccably maintained with modern amenities, we negotiated a reduced home warranty cost, citing the home's recent upgrades which appealed to buyers without significant upfront incentives.

Real Estate Expertise

Working with an experienced professional, like San Diego’s best realtor, can identify negotiating opportunities that aren’t immediately obvious. Understanding local market data and leveraging specific property advantages can keep more funds with the seller.

What Happens If Inspections and Assessments Are Skipped?

Inspections and assessments are integral to a successful home sale, and skipping them can introduce risk. Here’s why each is vital:

1.Home Inspection:This is a comprehensive review of the property’s visible condition, typically costing between $200 to $500. Skipping this might leave both parties blind to critical structural issues. I recall a client selling in Carlsbad who insisted on professional inspection—uncovering minor plumbing issues that preemptively addressed potential buyer concerns.

2.Pest Inspection:Particularly in more temperate San Diego areas like Oceanside, pest inspections are crucial to identify termite infestations. The average cost is around $100. A clean pest report assures buyers, reducing delays or negotiations post-sale.

3.Roof Inspection:Given San Diego’s year-round sunshine, roof conditions can sometimes be overlooked. An unexpected need for repair or replacement after skipping an inspection could cost thousands, potentially stalling or derailing sales.

Choosing to forego any of these inspections might lose a buyer’s confidence, potentially extending the time on the market or lowering sale price. Moreover, disclosures are paramount in jurisdictions like San Diego for protecting yourself legally and ethically.

San Diego Neighborhood Insights

San Diego's diverse neighborhoods come with their unique sets of closing cost factors:

La Jolla: Known for its upscale market, closing costs can be higher due to premium property value and demand for comprehensive due diligence.

North Park: This hip neighborhood attracts younger buyers, meaning negotiations over initial closing costs can be more prolific, with sellers offering benefits like home warranties more commonly.

Downtown San Diego: With a high turnover rate, sellers can often negotiate buyers to share more of the closing fees, especially during high-demand periods.

FAQs about Seller Closing Costs in San Diego

1. Can I Avoid Commission Fees?

While possible through forfaiting a real estate agent, the expertise and negotiation ability offered by the best San Diego broker often outweighs the savings, resulting in a smoother, often more profitable transaction.

2. Why Are San Diego's Title Insurance Costs Higher?

Title insurance costs can vary due to San Diego's complex property history and high property values—unique from other regions in California.

3. Can Closing Costs Be Tax Deductible?

Specific costs, like real estate taxes and mortgage interest, may offer tax advantages—consult with a tax advisor for personalized information.

4. How Often Does Seller Cover Closing Costs?

42% of home sales in the San Diego area report sellers covering partial closing costs or offering concessions, especially in surplus inventory markets.

5. What If My Home Doesn't Sell?

Listing but not selling can cost through staging, inspection, and minimal marketing fees, but aligning with a top-tier realtor mitigates prolonged listing times.

In conclusion, understanding and strategically navigating closing costs can make your San Diego property sale more profitable and less stressful. Remember, working with the best San Diego realtor, like myself, can guide you through these financial nuances, ensuring you get the most from your investment.

For personalized assistance, connect today.

Scott Cheng | Best San Diego Realtor & Broker

Call or text (858) 405-0002 • scott@scottchengteam.com